About Us

Region Group (RGN) owns and manages

101 convenience-based retail properties

valued at $4.8 billion

Many of our convenience-based retail properties have a strong weighting to food sales, due to grocery-based anchors such as supermarkets.

Region’s portfolio benefits from long-term leases to Woolworths Group Limited and Coles Group Limited, which act as an anchor tenant at most properties.

Woolworths and Coles are Australia’s largest retailers by sales revenue and number of stores.

Region Group is listed on the Australian Securities Exchange (ASX) under the code “RGN”.

$0bn

assets under management

0

total managed properties

0YRS

weighted average

lease expiry

0

specialty tenants

0 SQM

gross lettable area

*as at 31

December 2023

The past 11 years have seen our portfolio of convenience shopping centres grow. We are excited by

the opportunities ahead as we continue to expand and explore new ways to deliver on our vision.

– Chief Executive Officer, Anthony Mellowes

The Region Group executive team is lead by Anthony Mellowes as Chief Executive Officer who was instrumental in the founding of SCP, drawing on his extensive experience across the property and supermarket industry.

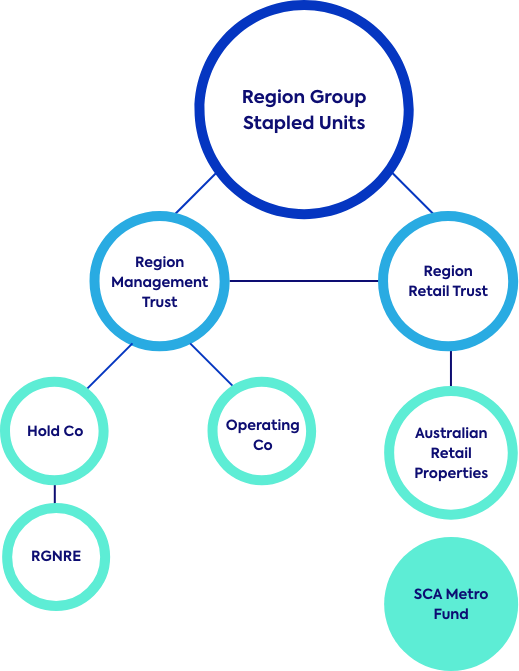

Region Group Stucture

Region comprises two registered managed investment schemes, Region Management Trust and Region Retail Trust.

The unit in each Trust are staples to form the stapled listed vehicle, Region Group (ASX: RGN), formerly known as SCA Property Group (ASX: SCP).

Our History

2012

We began our journey as SCA Property Group (SCP), originally formed by Woolworths, to act as the landlord and manage 56 convenience-based retail properties valued at $1.4 billion, in growing neighbourhood and regional areas.

Woolworths transferred its ownership to SCP, which was then listed on the ASX as a separate-independent real estate investment trust in December 2012.

2013

We acquired 7 mature neighbourhood centres, growing our portfolio to 72 shopping centres valued at $1.5 billion (includes New Zealand).

2015

SCA Property Group launched its first retail fund, SCA Unlisted Fund No. 1 (“SURF 1”). Launched first retail fund “SURF 1” in July 2015. SURF 1 comprised of five non-core assets acquired from SCP for $60.9 million.

2016

On 10 June 2016, we sold our portfolio of 14 shopping centres in New Zealand to Stride Property Group (NZX:STR). The sale was consistent with our strategy of divesting free-standing assets, and focusing on our Australian portfolio, which has a generally has a higher growth outlook.

2018

We acquired a portfolio of 10 convenience-based shopping centres from Vicinity, located in NSW, QLD, VIC and WA, for $573.0 million (7.5% implied fully let yield).

During the latter part of the year, we also implemented a brand refresh.

2022

It has been 10 years since we have listed and, in this time, our portfolio has grown to 91 convenience-based shopping centres valued at $4.46 billion*.

SCA Metro Fund joint venture with GIC successfully launched in April 2022 with a $284.5 million seed portfolio and acquired Beecroft in July 2022.

To support our vision and growth ambitions, we embarked on a name change and complete rebrand, which was revealed at our AGM on 23 November 2022. From 24 November 2022, we are now Region Group (ASX:RGN).

*As at 30 June 2022

Grow with us

We have strong growth ambitions, and we recognise not only hard work, but those who role model our values.

- Collaboration

We achieve and grow together as one team and know we can achieve more through our collective effort - Innovation

We embrace doing things differently to get people what they need, when and how they want it - Leadership

We stand for what people need and show the way forward - Trust Our word is our bond. We trust each other and we build trusted relationships with all of our customers and stakeholders

Collaboration

We achieve and grow together as one team and know we can achieve more through our collective effort

Innovation

We embrace doing things differently to get people what they need, when and how they want it

Leadership

We stand for what people need and show the way forward

Trust

Our word is our bond. We trust each other and we build trusted relationships with all of our customers and stakeholders